Cloud vs Desktop version for accounting software ?

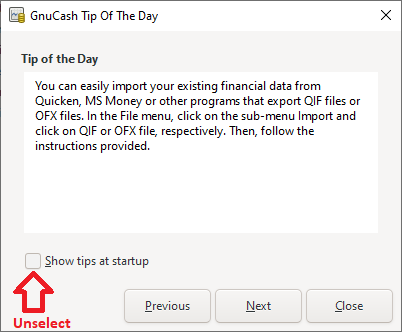

Nowadays many of the accounting / bookkeeping software are available in both desktop and public cloud versions. In fact, many of them do not provide an option for desktop version. It is a matter of convenience and personal preference as to which version is considered better before being chosen by each person. The cloud providers usually charge a monthly fee or annual fee. In my case, I do not want to send my personal data to a third party cloud provider and keep on paying monthly subscription. But above all, there is a danger of our accounts being compromised through hackers with the cloud. I strongly believe, the hackers wouldn’t spend time hacking into my personal desktop just to uncover some of my private data regarding my few hundred dollars. 🙂 But above all, a cloud provider has the option of freezing my accounts or kicking me out tomorrow, if, for example, few of my enemies bring forth a false allegation against me and forcing the cloud provider with few real or assumed consequences. 🙂 You might be inclined to think that this would be a very rare scenario. However, think twice. Similar situations have happened before, happening now and definitely will happen in the future. In any case, anyone could understand that the level of potential control the cloud providers have on their subscribers far exceeds that of the desktop software vendors on their customers. So, I always prefer desktop based bookkeeping and accounting software.

Transactions

Every activity of a business is done through transactions. Recording transactions on GnuCash is quite easier once the chart of accounts is setup. A transaction involves transferring money between two accounts within the chart of accounts. For most of the small businesses, transfer very often involves the bank accounts such as checking account and credit card account.

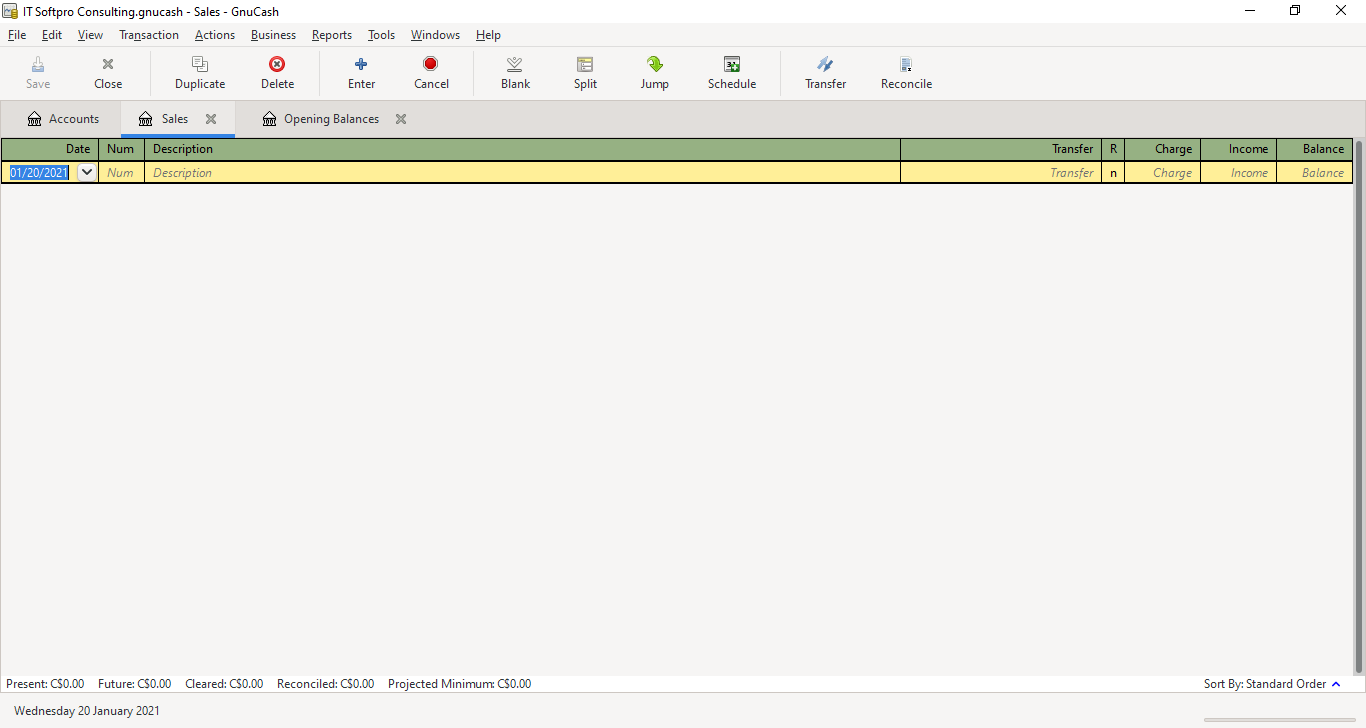

When an account is opened, the account register associated with that account opens. It is usually convenient to enter the transactions through account register. The following picture shows a sample blank account register associated with the sales account.

Values need to be entered as per the following list for each sales transaction record for the above sales account. Some of the fields are optional.

Date – date when the transaction took place or recorded

Num – It could be a sequence number for reference, a check number, etc.

Description – A descriptive line of text to give some information about what was transferred

Transfer – As the transfer is from the account associated with the currently opened account register (sales account in the above screenshot) and another account, this field should have the name of the other account involved. It can be selected from the list of accounts which shows up when clicking at the down arrow button.

R – indicates reconciliation status. The default value is ‘n’.

Charge (debit) – enter an amount to indicate if there is any charge or fee to be paid while doing the sales

Income (credit) – enter the amount received as a result of the sale

Balance – will be calculated automatically and displayed

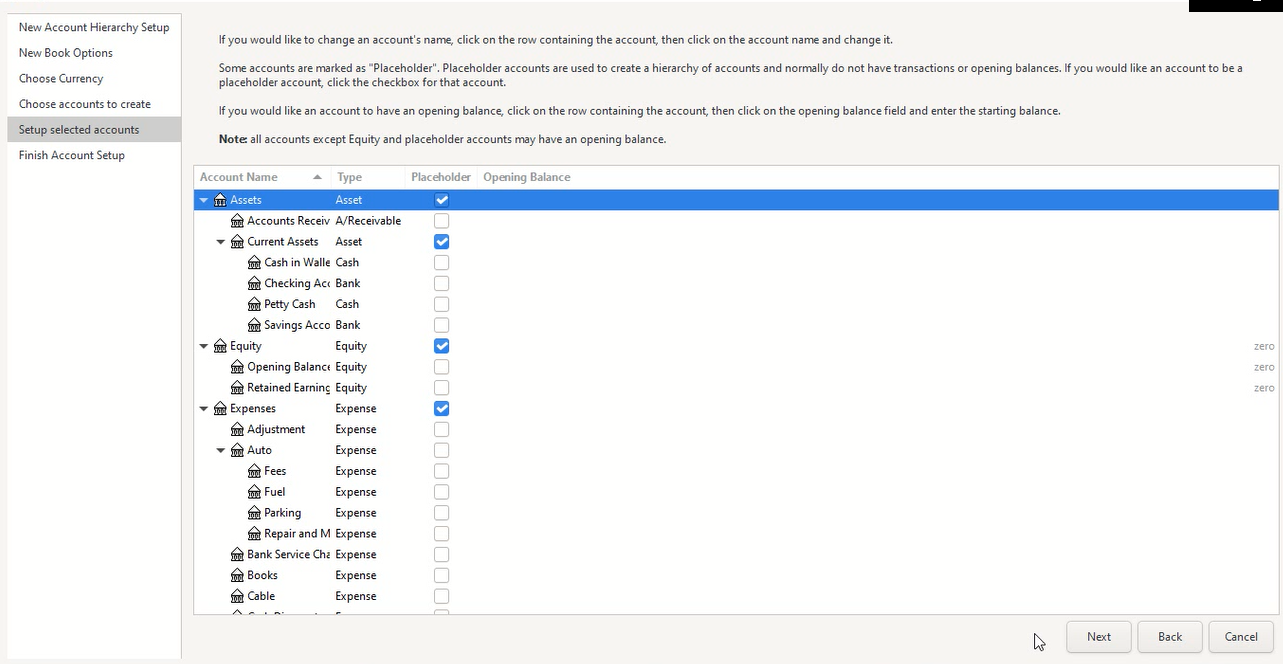

Opening Balances

Any accounting book will require a financial year start and end so that the appropriate reports can be filed with the government’s tax authorities. When a business starts from scratch, it may have all opening balances with 0 (zero) balances at the start of the financial year. But even with a fresh business, there might be an initial investment amount which might be deposited to the checking account and could be considered as opening balance. However, when you transfer from one system of accounting to another system, there are multiple accounts which will have balance amounts which need to be entered into the accounting system during the start of the financial year. These are the opening balances. GnuCash has provision for entering the opening balances of various accounts during the time of the creation of chart of accounts. It also has an account called “Opening Balances” under the Equity top level account, which can be utilized for entering the starting balances.

We have previously created a new file containing chart of accounts for a tentative business with default currency as Canadian Dollar (CAD). Let us enter the opening balances of the following from blank startup values on this account tree:

| Account Name | Opening Balance |

| Balance brought forward from previous year (checking account) | CAD 10000 |

| Credit Card Amount Payable | CAD 2000 |

| Office Furniture | CAD 1500 |

| Computer accessories & software | CAD 1500 |

| GST/HST Payables | CAD 3500 |

| Accounts receivable from customer | CAD 500 |

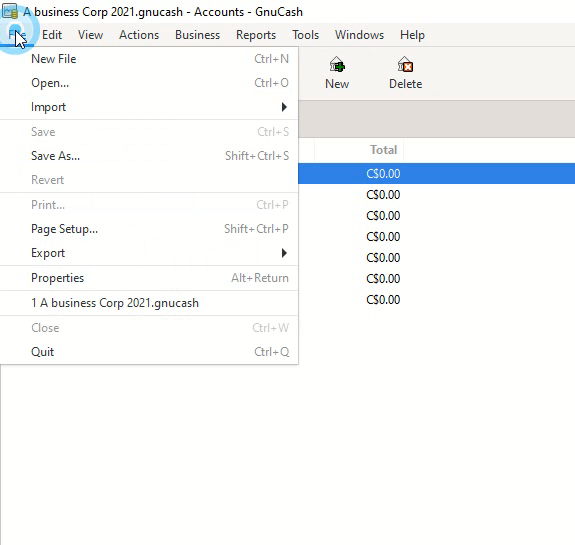

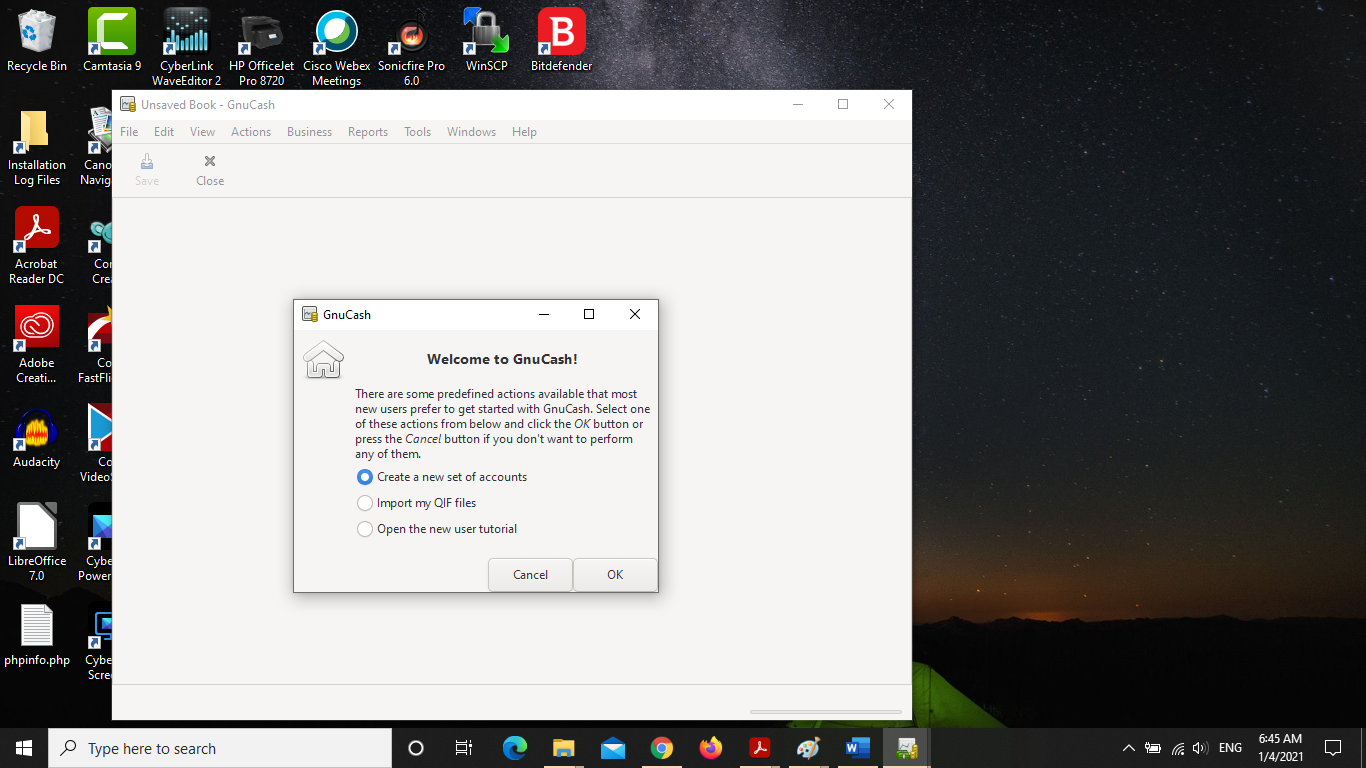

- Start GnuCash application and double click on Equity -> Opening Balances account. This will open the account registry.

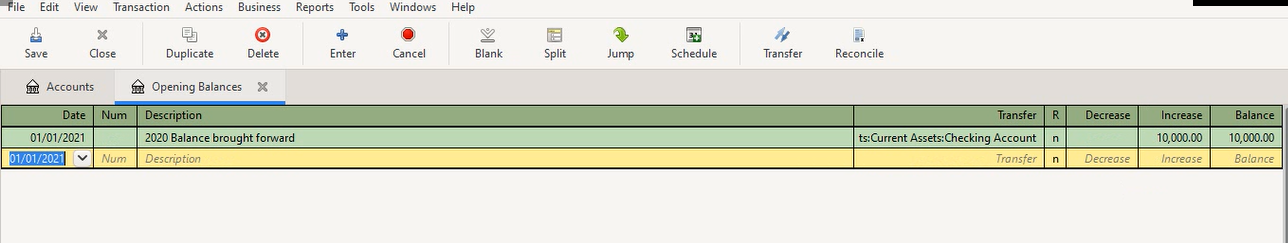

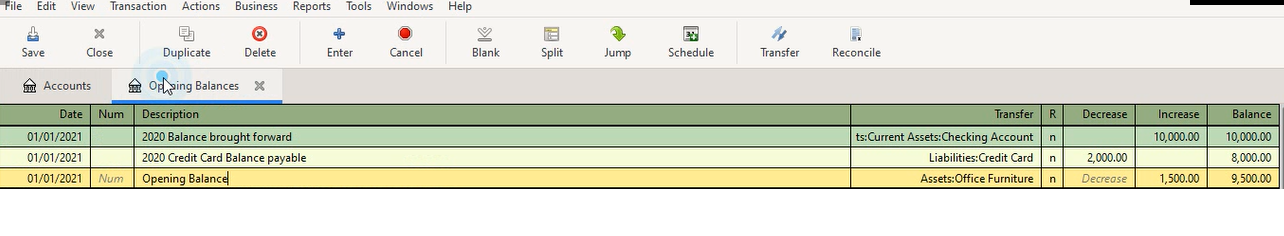

- On the first row which is blank, enter the date corresponding to the start of the financial year as 01/01/2021, at the Description field type as “2020 Balance brought forward”, Under Transfer field, select “Assets:Current Assets:Checking Account” and at the field Increase enter “10000”. This will display the “Balance” as CAD 10000. Click on “Save” button.

3. Click on the “Accounts” tab to see the status of the Accounts tree. The values of “Checking Account” and “current Assets” show $10000 now.

4. Open the Accounts register of Opening balances again and a the next blank line, enter the values for credit card balance payable. Select “Liabilities:Credit card” for the field Transfer from the list of accounts and enter the value of (CAD) 2000 under the field Decrease (Debit). This updates the Balance field (CAD) 8000.

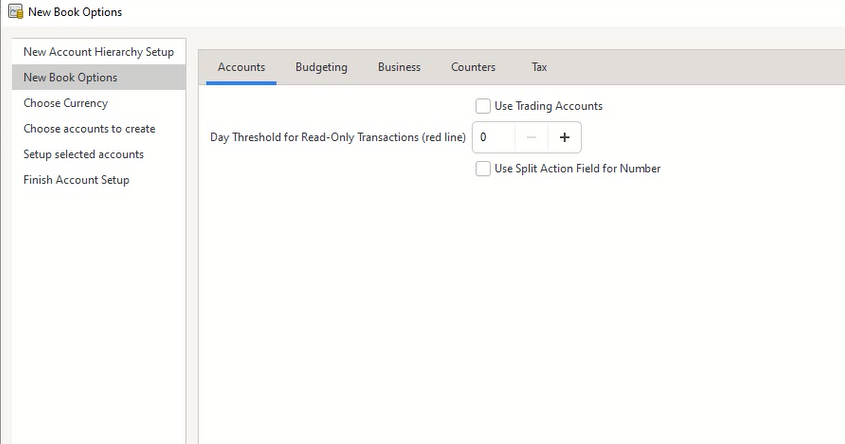

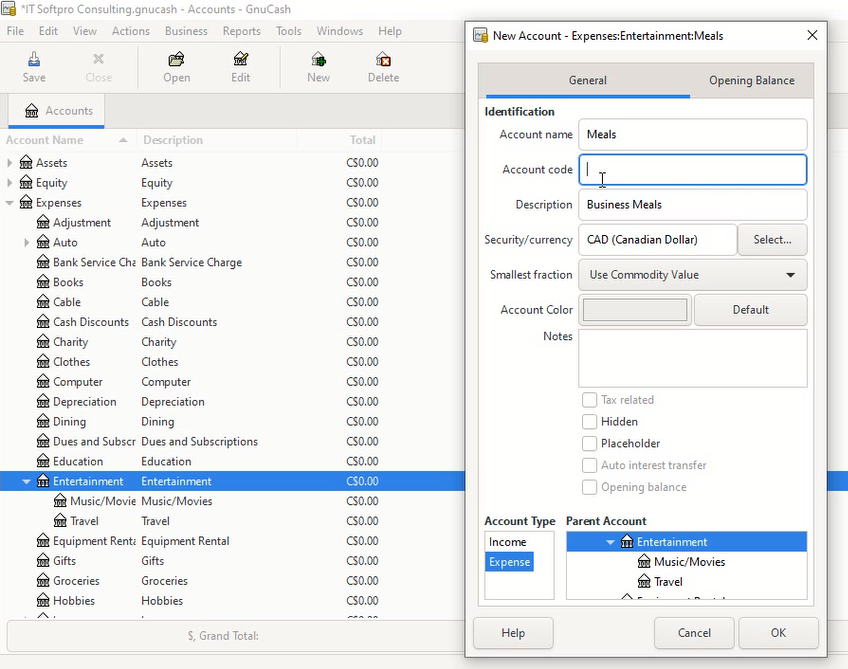

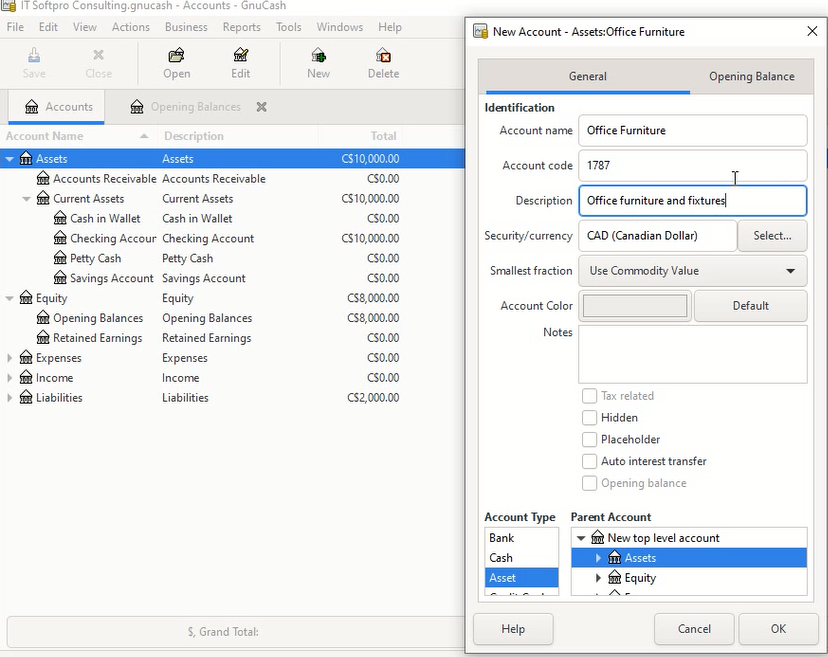

5. In order to enter the starting balance value of office furniture, we need to have an acount for this purpose under the top-level account “Assets”. Click on the Assets row and click the “New” icon on the top menu. This opens up a new dialog box for the details of the new account. Enter the values of Account name, Description and make sure the currency is selected as CAD. Under Account number enter the GIFI code 1787 associated with Office furniture. This (GIFI) is a Canadian standard account code. However, the account numbers can be updated according to the standards being followed at any specific country or based on a predefined account numbering system for the accounting tree. In the bottom of the dialog box, make sure the Account Type is selected as “Asset” and parent account is “Assets”.

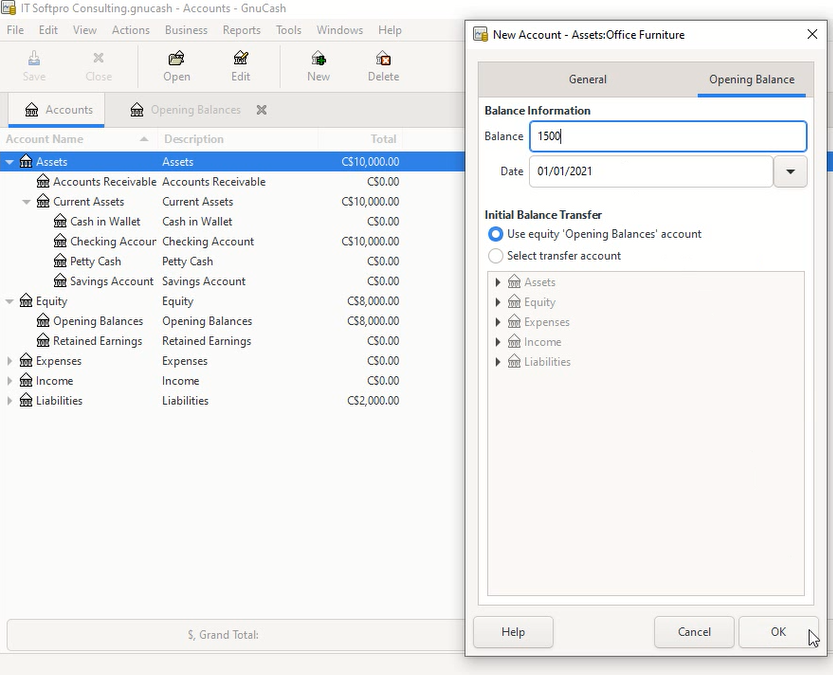

6. Click on “Opening Balance” tab and enter the values of Balance amount, date and then click OK button.

7. Now, view the account register associated with “Opening Balances” and notice the last row which indicate the new entry that has been added related to the new Office furniture account.

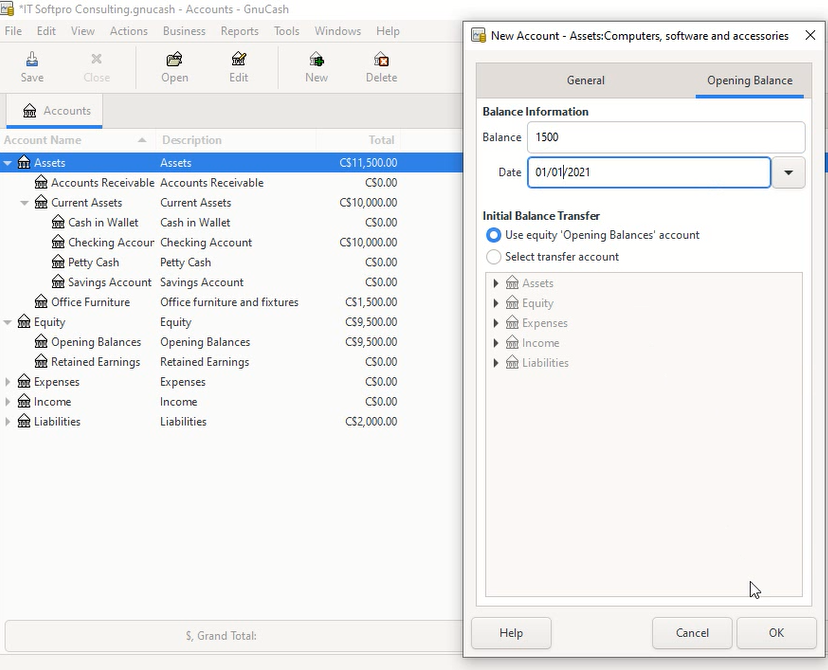

8. In order to enter opening balance for “Computers, software and accessories”, at the main Accounts tab, keep the Assets row selected and click on New icon. Enter the values as indicated in the screenshot below.

9. Click on the “Opening Balance” tab and enter the values as indicated in the following screenshot.

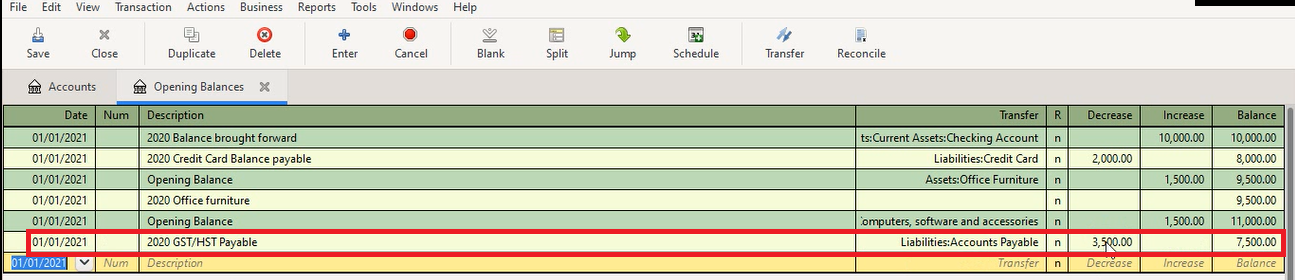

10. click on the Account register of Opening Balances tab, and select the last blank row. Enter the values for the fields as indicated in the highlighted (red box) line below for “GST/HST Payables”.

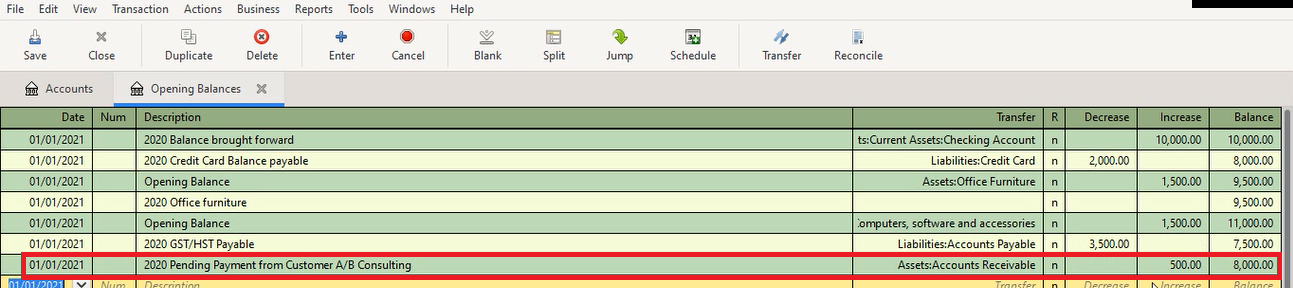

11. At the next blank row, enter the values as indicated in the highlighted (red box) section of screenshot below in order to update the details of accounts receivable from customer.

12. Click on the Accounts tab to see the final values updated to each account as a result of the transactions entered so far.